All Categories

Featured

Table of Contents

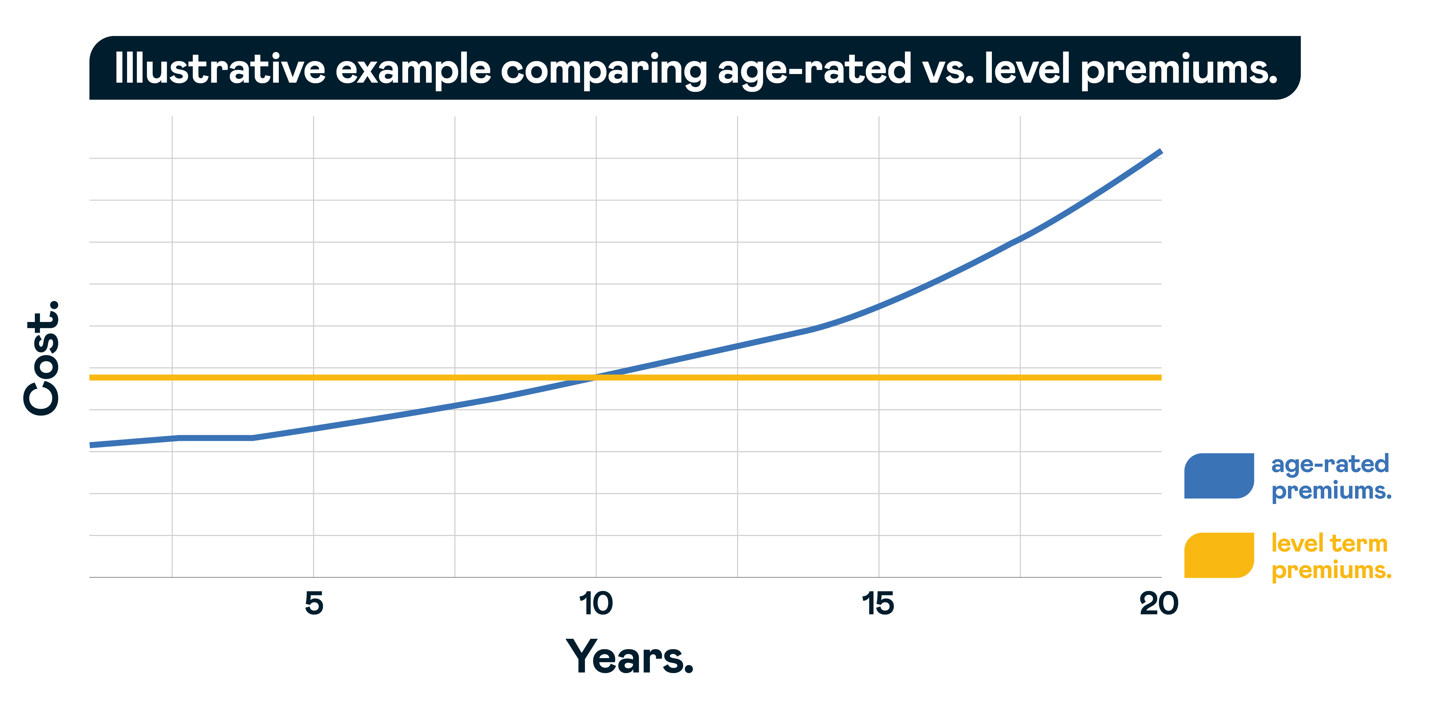

A level term life insurance policy plan can offer you satisfaction that the people that depend upon you will have a death advantage during the years that you are planning to sustain them. It's a method to help deal with them in the future, today. A degree term life insurance (in some cases called level costs term life insurance coverage) plan gives insurance coverage for an established variety of years (e.g., 10 or twenty years) while maintaining the premium payments the exact same for the period of the plan.

With level term insurance coverage, the cost of the insurance policy will certainly stay the exact same (or possibly reduce if returns are paid) over the regard to your policy, normally 10 or twenty years. Unlike permanent life insurance policy, which never runs out as long as you pay costs, a level term life insurance policy plan will end at some time in the future, usually at the end of the duration of your level term.

What is Guaranteed Level Term Life Insurance? Key Considerations?

Due to this, many individuals utilize long-term insurance as a steady financial planning device that can serve many requirements. You may have the ability to convert some, or all, of your term insurance during a collection period, typically the first 10 years of your plan, without requiring to re-qualify for insurance coverage even if your wellness has actually altered.

As it does, you may desire to include to your insurance protection in the future - Increasing term life insurance. As this takes place, you may want to at some point reduce your fatality benefit or take into consideration transforming your term insurance policy to a permanent policy.

So long as you pay your premiums, you can relax very easy recognizing that your enjoyed ones will certainly obtain a fatality benefit if you die throughout the term. Lots of term policies enable you the capability to transform to irreversible insurance coverage without needing to take one more health and wellness exam. This can allow you to make the most of the fringe benefits of an irreversible policy.

Level term life insurance is just one of the most convenient courses right into life insurance policy, we'll talk about the advantages and downsides to ensure that you can pick a strategy to fit your needs. Level term life insurance policy is one of the most usual and standard type of term life. When you're looking for momentary life insurance policy strategies, level term life insurance is one path that you can go.

The application process for degree term life insurance policy is commonly extremely straightforward. You'll fill out an application that has basic individual information such as your name, age, and so on as well as an extra thorough survey regarding your case history. Relying on the plan you want, you may need to join a medical checkup process.

The short response is no. A degree term life insurance plan doesn't develop cash worth. If you're wanting to have a plan that you're able to take out or borrow from, you may check out long-term life insurance policy. Entire life insurance coverage policies, for instance, allow you have the comfort of death advantages and can accumulate money worth in time, suggesting you'll have more control over your advantages while you live.

How What Is A Level Term Life Insurance Policy Can Secure Your Future

Riders are optional provisions included in your plan that can offer you fringe benefits and defenses. Motorcyclists are a great means to add safeguards to your policy. Anything can happen throughout your life insurance policy term, and you intend to be prepared for anything. By paying just a bit a lot more a month, bikers can give the assistance you require in instance of an emergency.

There are circumstances where these benefits are constructed into your plan, however they can additionally be readily available as a separate enhancement that calls for extra repayment.

Latest Posts

Funeral Insurance For Over 75

Fidelity Burial Insurance

How To Sell Final Expense Insurance