All Categories

Featured

Table of Contents

If you choose level term life insurance policy, you can allocate your costs because they'll remain the very same throughout your term. Plus, you'll understand precisely just how much of a survivor benefit your recipients will certainly obtain if you die, as this quantity will not transform either. The rates for degree term life insurance coverage will certainly rely on a number of elements, like your age, health status, and the insurance provider you pick.

As soon as you undergo the application and medical examination, the life insurance policy company will certainly evaluate your application. They should notify you of whether you've been approved soon after you use. Upon approval, you can pay your initial premium and sign any type of pertinent documents to guarantee you're covered. From there, you'll pay your costs on a month-to-month or annual basis.

You can pick a 10, 20, or 30 year term and take pleasure in the included peace of mind you are worthy of. Working with a representative can help you locate a plan that functions best for your needs.

As you search for means to secure your economic future, you've most likely discovered a wide range of life insurance policy options. group term life insurance tax. Choosing the right coverage is a big choice. You desire to discover something that will certainly help support your liked ones or the causes essential to you if something takes place to you

Several people lean towards term life insurance for its simplicity and cost-effectiveness. Degree term insurance, nonetheless, is a type of term life insurance that has constant settlements and a constant.

Term Life Insurance With Accelerated Death Benefit

Level term life insurance policy is a subset of It's called "degree" due to the fact that your costs and the advantage to be paid to your liked ones continue to be the same throughout the contract. You won't see any modifications in cost or be left asking yourself concerning its value. Some agreements, such as each year eco-friendly term, may be structured with costs that boost in time as the insured ages.

They're established at the start and remain the very same. Having constant settlements can assist you better strategy and budget due to the fact that they'll never ever change. Repaired survivor benefit. This is likewise evaluated the start, so you can understand precisely what fatality benefit amount your can expect when you die, as long as you're covered and updated on costs.

You agree to a set costs and fatality advantage for the duration of the term. If you pass away while covered, your death benefit will be paid out to enjoyed ones (as long as your costs are up to date).

You might have the choice to for one more term or, more most likely, restore it year to year. If your contract has a guaranteed renewability condition, you might not require to have a new medical examination to maintain your protection going. However, your costs are most likely to enhance since they'll be based on your age at revival time (what is voluntary term life insurance).

With this option, you can that will last the remainder of your life. In this case, once more, you might not need to have any brand-new clinical tests, yet costs likely will rise due to your age and new protection. direct term life insurance meaning. Various companies provide various options for conversion, make certain to recognize your selections before taking this action

Top Term Life Insurance With Accelerated Death Benefit

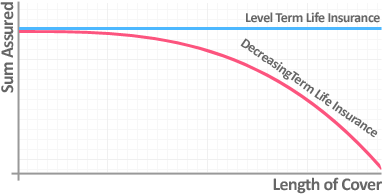

A lot of term life insurance is level term for the duration of the agreement period, however not all. With lowering term life insurance policy, your death benefit goes down over time (this kind is frequently taken out to specifically cover a lasting financial obligation you're paying off).

And if you're established for eco-friendly term life, then your premium likely will rise annually. If you're discovering term life insurance policy and wish to ensure straightforward and foreseeable monetary protection for your family, degree term might be something to think about. As with any type of kind of insurance coverage, it might have some limitations that don't fulfill your demands.

Top What Is Decreasing Term Life Insurance

Typically, term life insurance coverage is more affordable than permanent protection, so it's an affordable means to protect economic defense. Flexibility. At the end of your agreement's term, you have numerous choices to proceed or go on from coverage, often without needing a medical examination. If your spending plan or protection needs change, survivor benefit can be lowered gradually and lead to a reduced premium.

As with other kinds of term life insurance policy, once the contract ends, you'll likely pay higher premiums for protection due to the fact that it will recalculate at your present age and health and wellness. If your financial scenario changes, you may not have the essential protection and may have to purchase extra insurance coverage.

That does not imply it's a fit for everyone. As you're buying life insurance policy, here are a couple of vital variables to take into consideration: Spending plan. Among the benefits of degree term insurance coverage is you understand the expense and the survivor benefit upfront, making it easier to without bothering with boosts with time.

Age and health and wellness. Normally, with life insurance, the healthier and younger you are, the extra inexpensive the insurance coverage. If you're young and healthy, it may be an appealing choice to lock in reduced premiums currently. Financial duty. Your dependents and monetary obligation contribute in determining your coverage. If you have a young family, as an example, degree term can assist supply financial backing throughout crucial years without spending for protection longer than needed.

1 All motorcyclists are subject to the terms and problems of the biker. Some states may vary the terms and problems.

2 A conversion debt is not available for TermOne plans. 3 See Term Conversions section of the Term Collection 160 Product Overview for exactly how the term conversion credit history is determined. A conversion credit rating is not available if costs or costs for the new policy will certainly be waived under the regards to a rider providing disability waiver benefits.

Guaranteed Decreasing Term Life Insurance

Term Collection items are provided by Equitable Financial Life Insurance Coverage Firm (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Firm of California, LLC in CA; Equitable Network Insurance Agency of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a type of life insurance policy that covers the policyholder for a particular amount of time, which is recognized as the term. Terms usually vary from 10 to 30 years and increase in 5-year increments, offering degree term insurance policy.

Latest Posts

Funeral Insurance For Over 75

Fidelity Burial Insurance

How To Sell Final Expense Insurance